That's because there is no "Delete Invoice" button in Design Manager, because deleting invoices can cause some serious accounting issues.

"But everyone makes invoicing mistakes! How am I supposed to fix those?!" you say, and that's an absolutely legitimate point. In our past DM Tips, we covered updating invoices, which allows you to update invoice items and transaction descriptions and make minor adjustments to invoice amounts.

In this DM Tips, you will learn about reversing and crediting invoices. Reversing and crediting invoices is ideal for any major changes that need to be made to an invoice when a cash receipt has not yet been posted for the invoice. Once you post a cash receipt, you CANNOT credit/reverse the invoice.

Reversing and Crediting Invoices in Design Manager Cloud

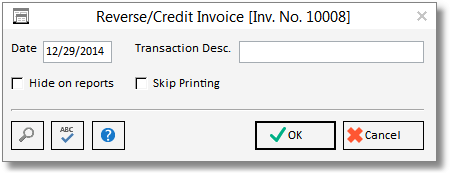

Go to the Documents and Accounting Window, select the Invoice, and click the Void Button. Alternatively, you can right-click the Invoice and select Reverse/Credit. This will open the Reverse/Credit Invoice Window.

You can optionally print a credit memo when using this function, which can be used for your records or given to the client as proof of the credit.

An Invoice cannot be reversed if it has any Payments, Adjustments, or prior credits applied to it. In order to reverse or credit the invoice, all entries attached to the invoice (payments, adjustments, credits) must first be voided. It also cannot be reversed if it is a Credit Invoice. A warning will appear to alert you when this happens.

Date: This is the date that prints on the Credit Invoice, and the date that the credit will be posted to the General Ledger. This date will default to the current date, but you may wish to "back date" the Credit Invoice to the original Invoice date in certain circumstances.

Transaction Description: You may optionally enter an explanation of the Credit (i.e. Merchandise Returned) for your future reference.

Hide on Reports: You can use this option to prevent the Credit Invoice and the original Invoice from appearing on certain reports.

Skip Printing: If you do not require a printed copy of the Credit Invoice, you can select this option. You can always Reprint it later if necessary.

Reversing and Crediting Invoices in Design Manager Pro Cloud

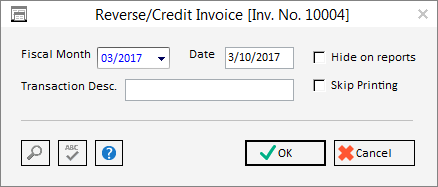

Go to Accounting -Client Invoices / Finance Charges to display the Client Invoices / Finance Charges Window and click the Existing Tab on that window. Then, click the Credit button which will open the Reverse/Credit Invoice Window shown below.

An Invoice cannot be reversed if it has any Payments, Adjustments, or prior credits applied to it. In order to reverse or credit the invoice, all Payment and Invoice Adjustments recorded for the Invoice must first be voided. A Client Invoice also cannot be reversed if it is itself a Credit Invoice or it has been credited previously. A warning will appear to alert you when this happens.

Fiscal Month: The Fiscal Month defaults to the original Fiscal Month of the Client Invoice.

Date: This is the date that prints on the Credit Invoice, and the date that the credit will be posted to the General Ledger.

Transaction Description: You may optionally enter an explanation of the Credit (i.e. Merchandise Returned) for your future reference.

Hide on Reports: You can use this option to prevent the Credit Invoice and the original Invoice from appearing on certain reports.

Skip Printing: If you do not require a printed copy of the Credit Invoice, you can select this option.

After properly configuring the above options, provided that the Skip Printing option is not selected, click the OK button to display the Print Credit Invoice Window from which the Credit Invoice can be reviewed in the Print Preview Window or sent to the printer.

After printing and reviewing the Credit Invoice, you will be asked to Accept or Reject the Credit Invoice. Accepting the Credit Invoice will post the Credit Invoice, effectively reversing the accounting of the original Client Invoice.

If the Skip Printing option is selected, you will immediately be asked "Are you sure that you wish to post this Credit Invoice?". Selecting Yes will post the Credit Invoice while clicking No will take no effect.

Accounting: Crediting an Invoice will reverse all of the accounting entries made by posting the original Client Invoice. If the Credit Invoice is made to a Fiscal Month different than the original Client Invoice then you may have open Accounts Receivable entry for the Client Invoice between the two Fiscal Months. You should not post a Credit Invoice to a period prior to the original Invoice.

If you have any questions on how to credit/reverse invoices, please ask them in the comments section below.