Whether you have a brand new business or an established business, you have been faced with a choice of how to report your business expenses and income. It may have been an easy decision for your company because of the nature of your business, but many small business owners labor over the decision. When reporting your business expenses and income you have two choices: cash or accrual accounting. In this article, we will help you understand the basics of the two reporting methods, the reasons why accrual accounting is more popular and how Design Manager follows accrual accounting.

The Cash Method

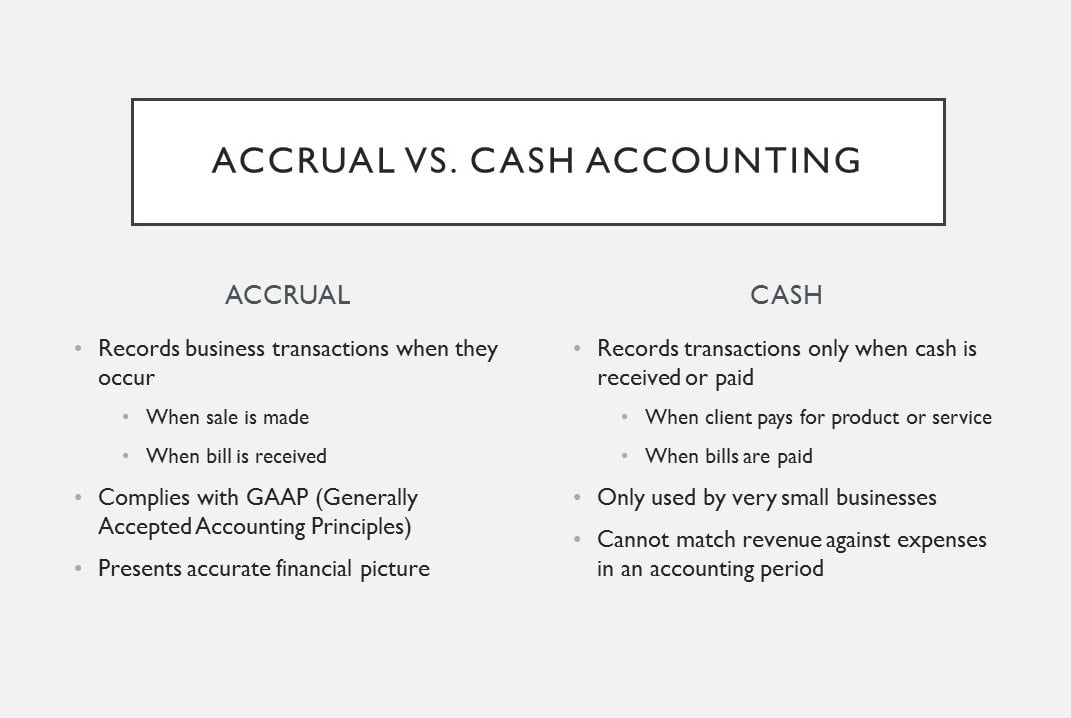

With the cash method of accounting, you record income only when you receive cash from your clients. Similarly, you record an expense only when you write the check to the vendor.

Most individuals use the cash method for their personal finances because it's simpler and less time-consuming. However, this method can misrepresent your income and expenses, especially if you extend credit to your clients, if you buy on credit from your vendors, or if you keep an inventory of the products you sell.

The Accrual Method

With the accrual method, you record income when the sale occurs, whether it be the delivery of a product or the providing of a service, regardless of when you get paid. Likewise, you record an expense when you receive the bill for goods or services, even though you may not pay for those goods or services until later.

The accrual method gives you a more accurate picture of your company's financial position than the cash method because you record income on the books when it is truly earned, and you record expenses when they are incurred. Income earned in one period is accurately matched with the expenses that correspond to that period so you see a clearer picture of your profits for each period.

Here is a chart that breaks out the differences:

You may not have a choice in the accounting method used for your business because the IRS states you must use the accrual method if:

- your business has sales of more than $5 million per year, or

- your business stocks an inventory of items that you will sell to the public and your gross receipts are over $1 million per year.

That is why it is best to make this decision together with your trusted CPA. The IRS has the guidelines for accounting methods and periods for you to review, but you should always work with your CPA and use their experience to set your company up for success.

Advantages of Accrual Accounting

More accurate view of your business' performance

Because accrual accounting tracks revenue and expenses as they are incurred, it creates a more accurate record of the business’s activities. Managers can use this information to identify sales trends, which they can use to better allocate company resources moving forward.

Can defer your tax liability

With accrual accounting, if you receive a deposit in 2016 for services that you agree to perform by the end of the following year, you can delay paying taxes on that income until the next tax year.

Complies with GAAP

In the United States, GAAP (generally accepted accounting principles) is considered the industry standard for preparing financial statements.

Allows for company growth

Companies in the United States with $5 million dollars in annual sales or $1 million dollars in annual inventory sales are legally required to use accrual accounting.

Design Manager uses Accrual Accounting

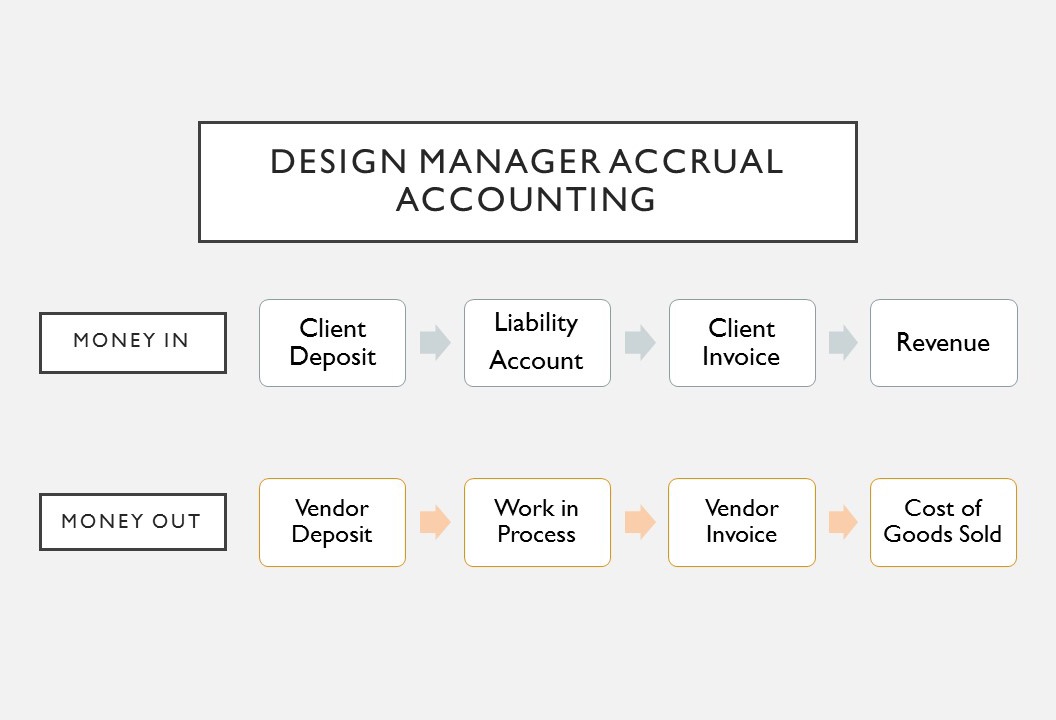

Because we realize that the above advantages are important to interior designers, Design Manager uses a standard project-cost accrual method of accounting where items are invoiced as they are delivered or when work is performed. This means that client deposits are held in a liability account on the balance sheet and cost of goods are held in a work in process account on the balance sheet. When the client invoice is done, signifying the completion of the order or the delivery of certain line items, the deposit is transferred to revenue and the work in process is transferred to Cost of Goods Sold (COGS). This makes sure profit is recorded together in the same fiscal period as the client invoice. Doing so prevents undesirable periods of negative income at the early stages of a project when purchasing occurs versus inflated income later in the project when the client is invoiced.

Here is a chart that demonstrates the flow through Design Manager:

In this article, we have helped you understand the basics of the two accounting methods, the reasons why accrual accounting is the preferred choice of business owners and how Design Manager follows accrual accounting.

As always, Design Manager recommends working with a trusted CPA who has experience in the design industry. A CPA can guide you through broad discussions like accounting methods, but can also help you with specific rules like sales tax, etc. We have a list of recommended accountants on our partners page.

We would love to hear from accountants or interior design business owners on your own experiences with reporting methods, so please leave your comments below.